SDFCU stands for State Department Federal Credit Union. It is a not-for-profit financial services provider serving over 80,000 members worldwide. SDFCU offers a variety of products and services, including checking and savings accounts, loans, credit cards, and investment services.

SDFCU membership is open to employees of the U.S. Department of State, their immediate family members, and certain other affiliated organizations. SDFCU is also a member of the National Credit Union Administration (NCUA), which means that member deposits are insured up to $250,000 per depositor.

Features Of SDFCU

SDFCU offers a variety of features to its members, including:

- Checking and savings accounts: SDFCU offers a variety of checking and savings accounts, including free checking accounts, high-yield savings accounts, and money market accounts.

- Loans: SDFCU offers a variety of loans, including personal loans, auto loans, mortgages, and home equity loans.

- Credit cards: SDFCU offers a variety of credit cards, including rewards cards, travel cards, and balance transfer cards.

- Investment services: SDFCU offers a variety of investment services, including mutual funds, ETFs, and stocks.

- Online and mobile banking: SDFCU offers a variety of online and mobile banking options, including bill pay, mobile deposit, and account alerts.

- Shared branching: SDFCU is a member of the CO-OP Shared Branch network, which means that members have access to over 5,000 shared branches nationwide.

In addition to these features, SDFCU also offers a variety of other services, such as:

- Financial planning: SDFCU offers financial planning services to help members reach their financial goals.

- Insurance: SDFCU offers a variety of insurance products, including life insurance, health insurance, and auto insurance.

- Travel services: SDFCU offers travel services to help members book flights, hotels, and rental cars.

SDFCU is a well-rounded financial institution that offers a variety of features and services to its members. If you are looking for a new financial institution, I encourage you to consider SDFCU.

What advantages come with joining SDFCU?

• 24/7 Access to the Account

Members of SDFCU have access to their accounts around-the-clock, allowing them to conduct transactions and view account information whenever convenient. This is done through online and mobile banking services, which let members use their computer or mobile device to check account balances, send money to another member, pay bills, and more.

Members may also access their accounts through ATMs and other credit union facilities. Members benefit from ease and flexibility because they may manage their accounts on their timetable thanks to the 24/7 account access function.

• Travel Advantages

The State Department Federal Credit Union (SDFCU) provides its members with some travel advantages: SDFCU provides foreign currency exchange services so that members can get the foreign money they need for their trip at reasonable prices.

- Credit Cards: SDFCU offers credit cards that can be used for travel-related expenses like flights, lodging, and rental cars. These cards are accepted worldwide and include Visa and Mastercard.

- Travel insurance: SDFCU provides its members with alternatives for travel insurance that can cover trip cancellations, delays, and unexpected medical expenses.

- Travel Aid Services: SDFCU provides its members with travel assistance services that can help and support them with concerns relating to travel, such as lost passports, emergency medical care, and more.

- SDFCU is a member of the Global ATM Alliance, enabling its users to withdraw money from ATMs worldwide without paying a surcharge. These travel perks can help members cut costs and offer peace of mind, making their trip more relaxing and stress-free.

• Earn Cash Back for Rewards

For the owners of its credit cards, State Department Federal Credit Union (SDFCU) provides a cashback rewards program. Members of this program can get cash back on their purchases, which they can use to either pay down an SDFCU loan or redeem it for the statement credit.

Some SDDFCU credit cards provide a cash-back rewards program. Different amounts of cashback can be collected depending on the type of card used and the volume of purchases made. Some cards give a more significant cashback percentage on specific expenditures, like gas or groceries. For new cardholders, certain credit cards also provide a sign-up bonus. Members can use the internet or mobile banking to check their rewards balance and redeem incentives.

Become a member of the State Department Federal Credit Union (SDFCU)

It is a non-profit financial services company with more than 80,000 members across the globe. Here are some easy steps you may take to join.

• Determine eligibility

You can sign up by being a member of an association, being related, and more.

• Collecting data

You must collect your personal information, such as your Social Security number, mailing address, and ID card.

• Make an account

Your account might first be created as a “savings account.” It only needs The cost to open is $1. You have two options for opening an account: online or in person at a branch.

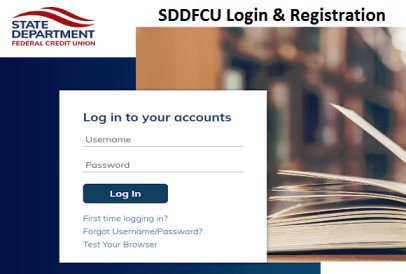

How can I log in to www.Sdfcu.Org?

- Open the sdfcu.org URL in any available web browser.

- You can log in using the dialogue box on the left side of the page.

- You can input the “username” and “secret key” into the designated boxes.

- Select the login link.

- You can log into your Sdfcu account once you have entered all the login information correctly.

How to get your password back at SDFCU

Don’t worry if you accidentally forget the secret login phrase; using the techniques listed below, you may quickly retrieve it.

- Open any of your browsers and navigate to sdfcu.org.

- Activate the sddfcu secret key reset URL.

- You must now type “Telephone number” and “sdfcu Username” into the corresponding fields.

- Select “Send me another secret key” from the menu.

- The secret key will be sent to your registered phone number or email address.

- Once you get your secret key back, logging into SDDFCU is simple.

What are the administrations at SDFCU?

- You can see your account history.

- The checks can be requested, and you can see the rejected ones.

- Transfer resources among the accounts.

- You can conveniently repay your SDFCU advances by using your credit card.

- Even your Mastercards can receive travel notifications.

- On this page, checking your tax paperwork is simple. You can quickly claim your cashback benefits and keep track of them.

Conclusion

Compared to other big banks, SDFCU offers various financial services to consumers in a better method and at lower prices. This portal won’t be the best option because many locals prefer to use their neighborhood banks instead of online banking services. Direct deposit, account alerts, the most competitive exchange rates, etc., are just a few of the services offered by SDFCU.

FAQs

Here are some frequently asked questions (FAQs) about SDFCU:

Q: How do I become a member of SDFCU?

A: To become a member of SDFCU, you must be eligible for membership. SDFCU membership is open to employees of the U.S. Department of State, their immediate family members, and certain other affiliated organizations. You can apply for membership online or by calling SDFCU at 1-800-733-3528.

Q: What products and services does SDFCU offer?

A: SDFCU offers a variety of products and services, including checking and savings accounts, loans, credit cards, investment services, insurance, and travel services.

Q: What are the benefits of being a member of SDFCU?

A: The benefits of being a member of SDFCU include competitive interest rates, low fees, a wide variety of products and services, convenient online and mobile banking options, personalized service, and the fact that SDFCU is a not-for-profit financial institution.

Q: Is SDFCU safe and secure?

A: Yes, SDFCU is safe and secure. SDFCU is a member of the National Credit Union Administration (NCUA), which means that member deposits are insured up to $250,000 per depositor. SDFCU also uses a variety of security measures to protect its members’ information.

Q: How can I contact SDFCU?

A: You can contact SDFCU online, by phone at 1-800-733-3528, or by visiting one of their branches.